According to new fourth quarter (Q4) data from the U.S. Chamber of Commerce Commercial Construction Index, more contractors in the roofing industry are facing a shortage of building materials as the pandemic continues. Most contractors (71 percent) say they have faced at least one material shortage, up 17 points from 54 percent in Q3 2020. In addition, there has been an accelerated increase in material cost for board feet of lumber and tertiary wood products. On top of materials shortage and rise in construction costs, roofing companies have experienced an unusual delay in deliveries of all available products.

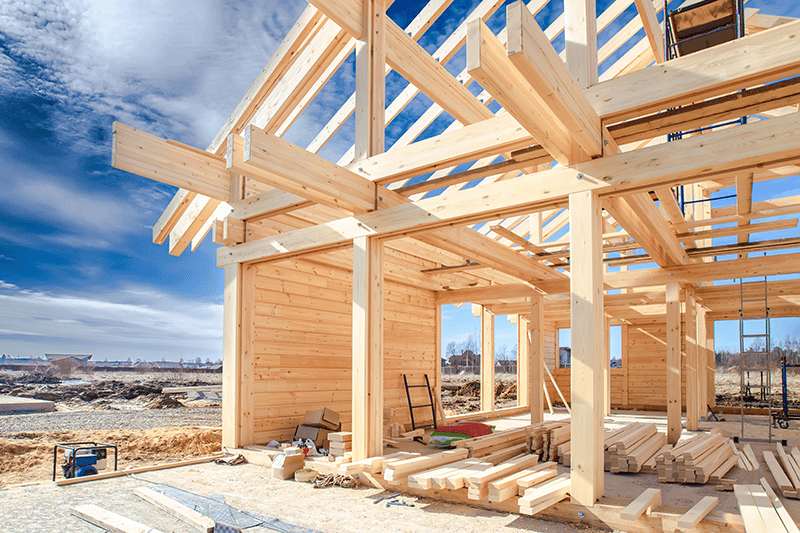

The most-reported material shortage is in wood products and lumber, which has seen higher demand from an increase in homeowner and residential construction during the pandemic. As indicated by building permits, builder contract projects in the construction industry (larger scale) have driven cost increases and pricing. Currently, 31% of commercial construction contractors report a shortage of lumber, up 20 points from 11% last quarter. Of those contractors experiencing shortages, 89% say it has a moderate to a high level of impact on their business, up from 75% last quarter.

The Chamber of Commerce’s quarterly report also shows contractors face increasing challenges due to COVID-19:

- 83% experiencing product delays and increased contract times.

- 71% struggling to meet schedule requirements.

- 68% experiencing at least one delay and expected into Q2 period of 2021.

- 58% putting in higher bids on projects and rate increases.

- 53% saying significant project shutdowns/delays are a top concern.

- 41% saying material shortages are a consequence of COVID-19.

- 39% turning down work opportunities.

Contractor Confidence Rises

Despite ongoing uncertainty over the future of commercial construction, contractors signal that they are cautiously optimistic about their medium to long-term prospects. Most contractors (85%), report a moderate to high level of confidence in the construction market to provide enough new business in the next 12 months. Up from 83% in Q3, and up 10 points from 75% in Q2 of 2020.

While the majority (61%) of contractors expect their revenue to remain about the same over the next year. A significant number of builders (25%) expect an increase, up from 22% in Q3, and fewer (14%) expect a decrease, down from 19% in Q3. Additionally, 20% of contractors expect to see profit margins increase over the next year, compared to 17% last quarter, assuming increases in material prices don’t continue to grow rapidly. These data also indicate that severe material shortages, including from roof material suppliers, are not expected to continue. While demand for materials will remain high, the time for materials delivery will be substantially reduced. Also, while material price increases may continue, material price stability from raw material producers is expected to return to normal levels.

Wood product and lumber shortages

A general construction material shortage is affecting a range of materials in the roofing and remodeling industries. During the pandemic, many wood product mills and other facilities were shut down or functioned with limited capacities. The decreased production came when mills would have increased production to meet unseasonably strong demand from increased building and remodeling. The increase in building is related to the pandemic that accelerated the shortage of housing supply and pent-up demand that already existed in both the U.S. and Canada (which produces a large portion of the softwood lumber). As vaccination rates for COVID-19 increase, mill production is ramping up with less need for procedures such as social distancing, and distribution delays are dissipating. In addition, log supply should increase in the coming months. Lumber supplies in the U.S. are expected to increase as high lumber prices bring additional production online, particularly in the southeastern U.S., and continuing into 2022 and 2023.

DIY repair and remodeling (R&R) demand has had an impact on supply. Big box retailers were designated ‘essential businesses’ during the shutdowns. They maintained a retail supply of building materials, which drew down reserves. Plywood and Oriented Strand Board (OSB) are two construction materials that have been in limited supply. This supply shortage for periods affected a wide range of activities, including roofing. The cost of lumber and other building products led to downstream price increases that have continued for current construction projects and future projects.

Big Box Stores reported record profits during the shutdown months. Lowe’s reported that second-quarter revenue increased 30% and net profit by 68.7%. The Home Depot reported that sales increased by 23% as consumers stuck at home during the coronavirus pandemic built decks, painted, repaired, and completed remodeling projects. Commercial lumber yards have experienced mixed effects from the COVID-19 pandemic.

Moderating lumber costs is likely to alleviate costs somewhat as normal life returns to the country. Families are traveling more, and general participation in the economy’s service side has begun to recover. However, this spring has brought powerful storms, and if widespread damage from an unusually active season continues, the need for repair will produce upward pressure on demand for building materials.

The global pandemic reducing lumber and building material production while simultaneously driving an increase in already high demand was not only unexpected but unprecedented. No one expected lumber prices to climb as high as they already have, and the truth is that no one knows how high lumber prices will get or when this surge will end. It will depend on the equilibrium between the supply chain and ongoing demand. Until the supply of lumber available equals or exceeds the demand for lumber, prices will remain high, and project completion delays will continue.

RESOURCES

Blue Nail Roofing has a Master Elite contractor status awarded by the largest roofing manufacturer in North America, GAF. Only 2% of contractors in the U.S. meet the rigorous standards to achieve this status, which means you can be assured you are making a good choice when you select the professionals at Blue Nail to execute your home and business roofing repairs. Call today to schedule a professional evaluation!

Copyright © 2020 Blue Nail Enterprises. All rights reserved. | Privacy Policy

Let Us Nail Your Project!

Send us a little information about your roofing or home improvement needs and an expert will reach out shortly.